Blog

By Alejandro Cardot

Promoting Private Debt to Retail Investors While Stretching The Value of Financial Assets, with KPMG’s “Seal of Approval”

Today Bridging Finance is a synonym for investment loss. To my surprise, I found someone who is fooling himself with a 9-figure investment in Bridging

Will KPMG seize their second chance with Canadian private debt investors?

Auditors are supposed to know the business they are auditing, including the general economic, business, and fundraising environment. But they should look at that info …

Lessons from Bridging: How to Scrutinize a Private Debt Fund – Part II

Private credit markets can be treacherous. Look no further than the allegations surrounding Bridging Finance. In 2020, a Commission staffer from the SEC said …

Lessons from Bridging: How to Scrutinize a Private Debt Fund – Part I

Many investors and advisors were surprised after a court placed Bridging Finance into receivership. Some investment professionals ignored the warnings and now tell their clients that they are victims of Bridging’s…

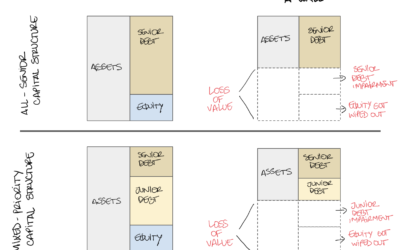

Lessons from Bridging: The Myth of Senior Security

The high yield investments made by Bridging and other private debt funds increase the probability of a permanent capital loss. Some private debt managers, such as David Sharpe, say that they can avoid losses and deliver premium returns. But how?

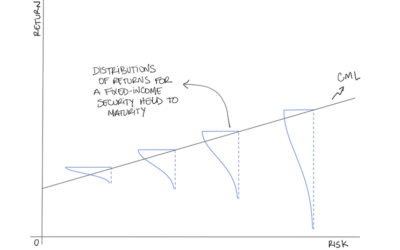

Lessons from Bridging: Risk-Return Proposition of Private Debt Funds.

Bridging Finance’s returns proposition was very appealing. In a zero-interest rate environment, they delivered consistent gross returns of over 9%. Under an enchanting narrative …

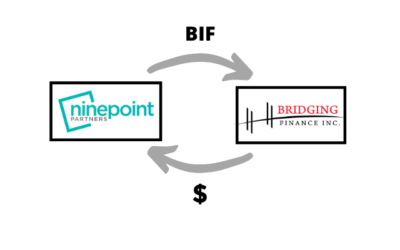

Why Ninepoint sold its stake in the Bridging Income Fund

In the Fall of 2018, Ninepoint Partners sold their interest in the Bridging Income Fund (BIF). That transaction is one of the focuses of an OSC investigation that placed Bridging…

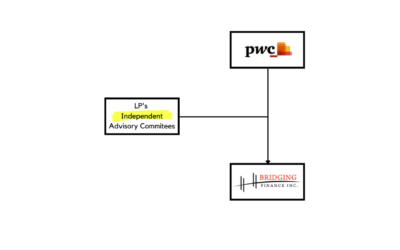

What should Bridging Finance’s investors do?

Since the actions of the OSC to place Bridging Finance funds in receivership, most of the 25,900 investors have not come to terms with the fact that they will lose money. According to the Receiver, “many Unitholders have…

What should Bridging Finance’s investors expect?

After the actions enforced by the OSC on Bridging Finance, investors in those funds will start questioning when they will get their money back. But the question shouldn’t be when, but how much will they get back?

Contact Us

If you have any questions, please reach out!